Income Tax Refund Tally Entry . forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial transactions. For example voucher date, quantity of units sold rate per unit,. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a.

from legaldbol.com

in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. accounting vouchers in tally are documents containing details of financial transactions. forgot to include interest on last years income tax refund. For example voucher date, quantity of units sold rate per unit,.

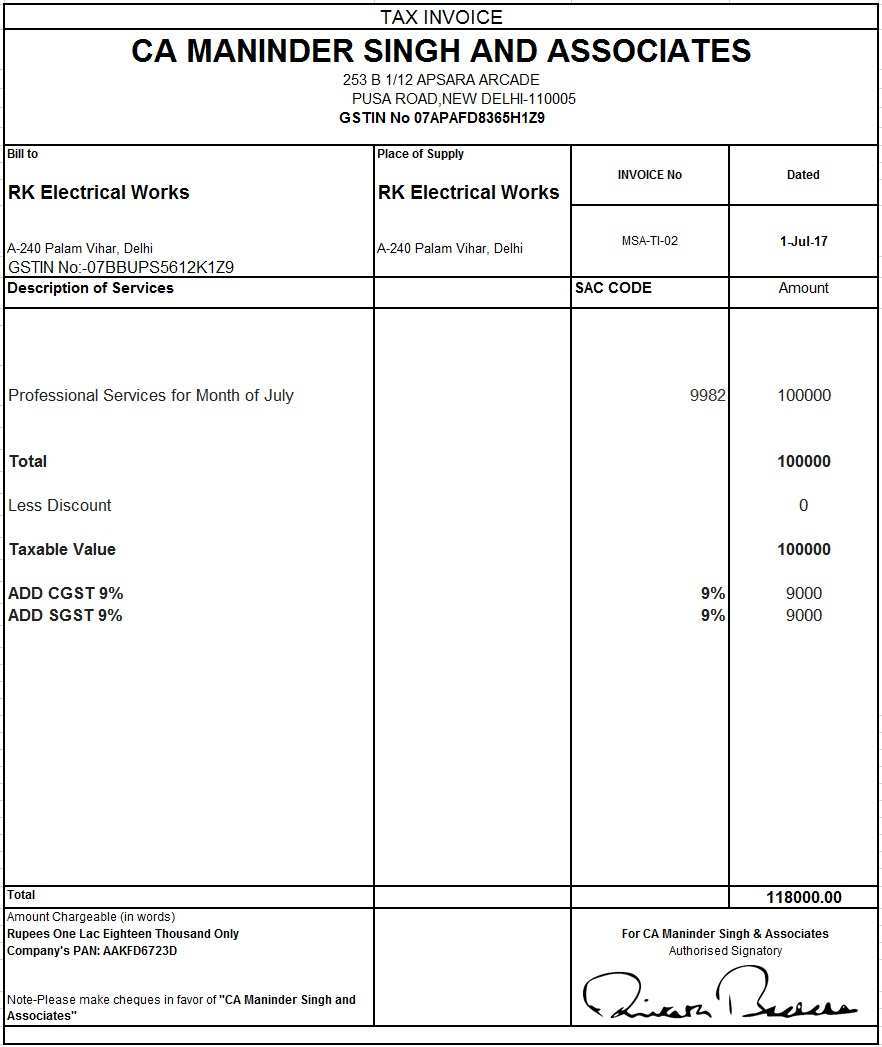

Tax Invoice Format Tally Cards Design Templates

Income Tax Refund Tally Entry forgot to include interest on last years income tax refund. For example voucher date, quantity of units sold rate per unit,. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial transactions.

From www.youtube.com

Advance Tax Entry in Tally Prime Tally Prime Learn to Win YouTube Income Tax Refund Tally Entry For example voucher date, quantity of units sold rate per unit,. forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from. Income Tax Refund Tally Entry.

From www.tallyknowledge.com

Lesson 43TDS (Tax Deducted at Source) in Tally.ERP9 Income Tax Refund Tally Entry forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From www.youtube.com

Interest on Tax Refund Entry in Tally Interest on IT Refund Income Tax Refund Tally Entry For example voucher date, quantity of units sold rate per unit,. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial. Income Tax Refund Tally Entry.

From ecom2tally.in

How to record TDS Deducted by Amazon in Tally? Income Tax Refund Tally Entry forgot to include interest on last years income tax refund. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. accounting vouchers in tally are documents containing details of financial transactions. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From www.youtube.com

GST REFUND ENTRY IN TALLY ERP9 6.5.2 YouTube Income Tax Refund Tally Entry forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From www.tutorialkart.com

How to Create Group in Tally and How to Alter & Display TutorialKart Income Tax Refund Tally Entry accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax refund. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From www.youtube.com

GST Refund Entry in Tally /GST Adjustment Entry / GST Payment Entry in Income Tax Refund Tally Entry For example voucher date, quantity of units sold rate per unit,. accounting vouchers in tally are documents containing details of financial transactions. forgot to include interest on last years income tax refund. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from. Income Tax Refund Tally Entry.

From help.tallysolutions.com

How to Record Tax Payments in TallyPrime (Payroll) TallyHelp Income Tax Refund Tally Entry in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. accounting vouchers in tally are documents containing details of financial transactions. forgot to include interest on last years income tax refund. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From caknowledgea.pages.dev

How To Pass Payment Entry In Tally Prime 2022 Screenshots caknowledge Income Tax Refund Tally Entry For example voucher date, quantity of units sold rate per unit,. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial. Income Tax Refund Tally Entry.

From help.tallysolutions.com

How to Record Tax Payments in TallyPrime (Payroll) TallyHelp Income Tax Refund Tally Entry For example voucher date, quantity of units sold rate per unit,. accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax. Income Tax Refund Tally Entry.

From www.teachoo.com

Entries for TDS Receivable and Provision for Tax Chapter 8 TDS Recei Income Tax Refund Tally Entry accounting vouchers in tally are documents containing details of financial transactions. forgot to include interest on last years income tax refund. For example voucher date, quantity of units sold rate per unit,. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from. Income Tax Refund Tally Entry.

From www.youtube.com

Tax in Tally.ERP 9 YouTube Income Tax Refund Tally Entry For example voucher date, quantity of units sold rate per unit,. accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax. Income Tax Refund Tally Entry.

From www.svtuition.org

Accounting Treatment of TDS in Tally.ERP 9 Accounting Education Income Tax Refund Tally Entry accounting vouchers in tally are documents containing details of financial transactions. For example voucher date, quantity of units sold rate per unit,. forgot to include interest on last years income tax refund. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from. Income Tax Refund Tally Entry.

From www.svtuition.org

How to Pass TDS Voucher Entries Under GST in Tally.ERP 9 Accounting Income Tax Refund Tally Entry accounting vouchers in tally are documents containing details of financial transactions. For example voucher date, quantity of units sold rate per unit,. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. forgot to include interest on last years income tax. Income Tax Refund Tally Entry.

From www.youtube.com

TDS in Tally TDS Deduction & Refund Entries in Tally YouTube Income Tax Refund Tally Entry forgot to include interest on last years income tax refund. accounting vouchers in tally are documents containing details of financial transactions. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From www.youtube.com

Accounting for Deferred Taxes (IFRS) and Future Taxes Income Tax Refund Tally Entry forgot to include interest on last years income tax refund. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. accounting vouchers in tally are documents containing details of financial transactions. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.

From www.youtube.com

Tax Provision Entry in Tally.ERP 9 Advance Tax Payment Entry Income Tax Refund Tally Entry accounting vouchers in tally are documents containing details of financial transactions. For example voucher date, quantity of units sold rate per unit,. forgot to include interest on last years income tax refund. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from. Income Tax Refund Tally Entry.

From ecom2tally.in

How to record TDS Deducted by Amazon in Tally? Income Tax Refund Tally Entry accounting vouchers in tally are documents containing details of financial transactions. forgot to include interest on last years income tax refund. in tally sales entry is a method of record keeping of transactions in tally accounting software that describes the transfer of goods and services from a. For example voucher date, quantity of units sold rate per. Income Tax Refund Tally Entry.